Crude Oil Futures Drop to Historic Lows This Week

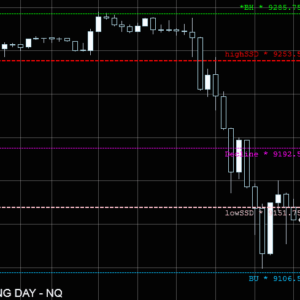

Crude Oil futures contracts for May Delivery fell to historic lows this week with the price touching 17.31 on Friday’s session and putting in a weekly close at 18.12 which is well under the psychological round figure of 20.00. This is due to an unprecedented decline in demand no doubt related to the extreme geopolitical crisis.

The mass shutdown in the greater parts of the global economy has dealt a tremendous blow to commerce and industry which is now changing virtually everything about life as we know it. The import/export market is in a massive contraction and that puts tremendous pressure on Heating Oil and RBOB Gasoline.

Trucking and freight activity is in a severe decline and unless the lockdown is lifted immediately the devastating effects to this energy market will not be contained. The average consumer is out of work or working from home and not getting in their cars for much of anything except to make necessary survival runs.

This dramatic reduction in activity further impacts the gasoline market with the consumer making far fewer trips to the pump. The powers that be at OPEC have made decisions to cut production at facilities around the world in an effort to stabilize the price with the drop off in demand. One interesting argument is that production could be to zero and it still would not stop the fall of prices right now.

Oil producing companies are in danger of the price continuing to fall becuase they have counted on higher prices in the future. They have borrowed large sums of money to purchase equipment, labor, and storage space for their product that is now worth in some cases less than 50% of the projected sale price. These companies are greatly exposed to the risk in this market.

The amount of supply is probably the greatest in history because the production levels were maintained up until very recently. It was impossible for the market to accurately react and determine what was happening. Hindsight is always 20/20 and what was done cannot be undone.

The exchange is rewriting their software to allow for the unthinkable and very strange concept of negative oil prices trading in the open market. The fact of the matter is that there is nowhere to store all of the oil that is being produced. When a system breaks down it does not return to normal right away. It is very unclear what is going to happen with the energy industry going forward.

It is very unwise to speculate on the price of oil for the long term here as world leaders will be constantly engaging in market activities in response to this situation. Expect wild swings in this market as it attempts to find equilibrium. The Oil market has broken support around $20 and is expected to trade much lower into the $10-$15 range in the near term future.